Growing Beef Newsletter

April 2025, Volume 15, Issue 10

Concerns about Tariffs and Current Trade Flows

Chad Hart, ISU extension economist

Agricultural markets, for both livestock and crops, have been working through what seems to be the constantly evolving policy around trade, especially tariffs. As I write this article at the end of March, the markets are bracing for more potential changes in trade policy as President Trump has indicated he will provide more details on his trade agenda then. Through the first two months of his new administration, President Trump has used the threat of tariffs as a negotiating tactic to spur on changes in other countries, mainly dealing with issues such as immigration and illicit drug trade. But we have seen a few new tariffs enforced, mostly with China. Those tariffs haven’t really changed the direction of trade flows, but they have reinforced a general decline in US agricultural sales to China.

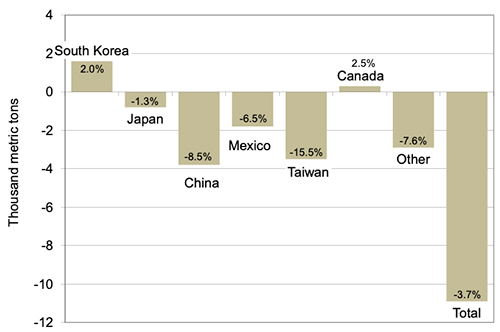

As things currently stand, most of our trade relationships are still facing the same trade policies as under the previous administration, but again, that could likely change in April. The concern for Iowa’s agricultural markets is how our major trade partners are adjusting or will adjust to changing US tariffs. The general expectation is that most will respond with new tariffs on US goods flowing to those countries. Hence, the markets are preparing for fewer export sales. And as we look the meat markets, we do find fewer export sales than a year ago. Figures 1 and 2 show the year-over-year shifts in beef and pork export sales. The graphs highlight the 6 largest export markets for the meats (with the first 6 bars in the charts, with the countries listed in order of the size of sales) and summarize the sales to smaller markets (in “Other”) and the overall global market (in “Total”). Arguably, for beef, the downturn in export sales was expected, as the continuing shrinkage in the cattle herd is leading to lower beef production, and thus, less beef available for export. Compared to last year, US beef export sales are down roughly 4%. Most of this retreat has been in the Chinese and Taiwanese markets. Yet, despite the general reduction in export sales, US beef is still finding a couple of growth markets: South Korea and Canada. South Korea is currently the top export market for US beef and Canada has increased US beef purchases despite the on/off nature of tariffs over the past couple of months. However, with China, Canada, and Mexico being the countries most mentioned by the President for tariffs and those countries also being three of the top 6 markets for US beef exports, we could see further erosion in beef exports.

Figure 1. US Beef Export Sales (Source: USDA-FAS).

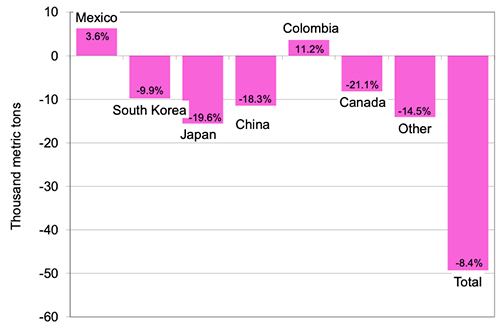

For pork, we see the same general pattern. Overall sales are down over 8%, compared to last year. The vast majority of the decline is from Asian markets, this time with South Korea and Japan joining China in purchasing less US product. All three of the major tariff targets (China, Canada, and Mexico) are in pork’s top 6 markets. But again, as with beef, there are a couple of growing sectors, this time in Latin America, with Mexico and Colombia purchasing more US pork.

Figure 2. US Pork Export Sales (Source: USDA-FAS).

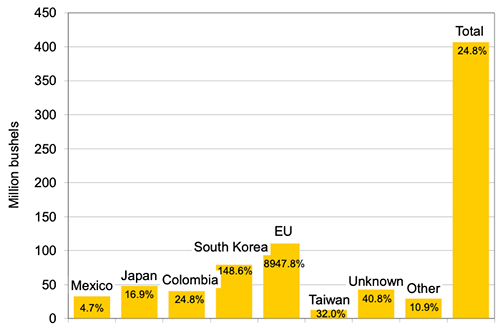

Figures 3 and 4 show the year-over-year shifts in corn and soybean export sales. Please note with the crop graphs, there is an additional bar labeled “Unknown” for export sales currently designated for unknown destinations. These are often sales to multi-national companies that may want delivery to a number of different ports. Once the crop is loaded for export, the destination is noted and those sales are moved to that country’s ledger. Unlike the shifts in meat, the crop markets have experienced some sizable growth in export sales during the current marketing year (which started last fall). Corn has captured the largest gains, with all of the top 6 countries/regions (as the European Union is aggregated in USDA’s export data) increasing corn purchases relative to last year. While corn sales to China have retreated significantly, with China dropping from our 4th largest market with the 2023 crop to our 31st largest market for 2024, the growth outside of China has not only filled in those losses, but also led to a nearly 25% expansion in corn sales. Some of that growth, especially in the EU, is due to smaller crops in the Black Sea region. Last year, Europe met much of its feed grain needs with Ukrainian crops. This year, US crops are filling the void.

Figure 3. US Corn Export Sales (Source: USDA-FAS).

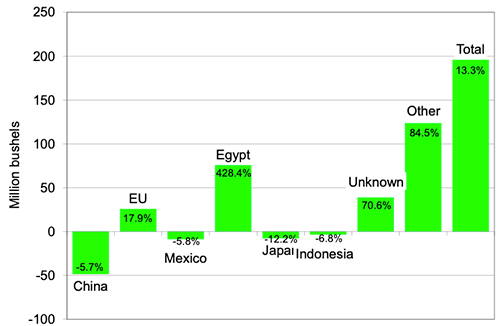

Soybean exports have grown as well this year, despite the retreat from China. China remains the largest market for US soybeans, but other markets have picked up the slack thus far. Overall, soybean export sales have increased by roughly 13%. Most of the growth for soybeans has been in traditionally smaller markets. But we have also seen gains in the EU and Egypt, likely related to the limited crops coming out of the Black Sea region.

Figure 4. US Soybean Export Sales (Source: USDA-FAS).

As can be seen from the four graphs, there are a few key countries for Iowa’s major ag products. Mexico and Japan are large consistent customers for all of the big four commodities. South Korea and China appear for three of the four commodities. Canada, Taiwan, Colombia, and the European Union show up for two of the four commodities. Most of these countries have come up during the tariff discussions: Canada, Mexico, and China in relation to immigration and drug trafficking, among a variety of issue; Colombia in relation to immigration and the acceptance of deportees; and the European Union with steel and aluminum tariffs. And in most cases, those countries have chosen to respond with proposals for retaliatory tariffs, often targeting US agricultural products. Given the expectations of larger corn, soybean, and pork supplies in 2025, those commodities can use all of the export growth they can find. And while beef production and exports are shrinking, the beef market relies on international trade to balance out supplies to match US consumption patterns, bringing in lean beef for hamburger and sending out either high-end cuts or offal for international consumption. Thus, sudden policy shifts, like tariffs, can have significant impacts for agricultural markets. With the tariff arena still in a state of flux, we can’t state solid numbers for the financial impacts of the potential tariffs. But we can observe how the markets quickly and directionally move with each trade policy story, with ag prices falling with tariff announcements and rising on tariff postponements.

This monthly newsletter is free and provides timely information on topics that matter most to Iowa beef producers. You’re welcome to use information and articles from the newsletter - simply credit Iowa Beef Center.